Malaysia Car Insurance Addon

Third party fire and theft aka. Standard special peril rate for all insurance company is 05 but theres also a limited special peril which cover flood typhoon which is half of it or 025.

Flood Damage Coverage For Car Insurance In Malaysia How Much Does It Cost For Special Perils Add On Paultan Org

Therefore the amount you have to pay is RM250 for a one-year coverage.

. However you can customize the plan with add-ons of your choice. Find out more about the 3 policies that are available in Malaysia. Minimum windscreen value is RM300.

This car takaful plan is comparable to conventional car insurance. Carly is a free online motor insurance comparison platform on which you can compare and choose the best insurance plans for your vehicle from a wide range of insurance providers in Malaysia. Call your car manufacturer customer service.

Third-party fire and theft coverage. Qoala Malaysia provides comprehensive motor insurance for any motor damage or loss. However aside from the law sufficient protection for car insurance is also necessary for your vehicle for repair costs or replacement if anything awful is involved like a collision natural disaster or theft.

This add-on covers you and your passengers when you are on the app and available to accept requests or on the job. To know what your car insurance covers you need to first check which one of the three types your policy falls under. MSIG Comprehensive Private Car plan shared the same benefits as MSIG Motor Plus Insurance the only difference is this plan did not come with add-ons benefits.

Each of these policies provides different kinds of coverage. Enjoy the many benefits of the best car insurance for you. Contact our Customer Service now.

To determine your car windscreen value you can refer toconsult the following areas. At Zurich Malaysia we understand that protecting your car is also about protecting your precious family and you. Learn more about that and the relaxation period here.

Get Up To RM100 TNG When You Renew Your Car Insurance With Us. Personal Accident cover of RM50000 due to accidental injury or death of the Authorised e-Hailing Grab Driver. There are three main types of car insurance in Malaysia.

Car insurance is a necessity and requirement by law when you purchase a vehicle. Will I be refunded if my policy is cancelled during purchase. As the sum insured for your car is RM50000 you will have to pay 05 of the amount to enjoy the coverage.

In order to know the exact amount you have to pay for any additional coverage get free car insurance quotes online. Qoala Technology Sdn Bhd Company No. It will be stated if you have selected windscreen coverage with the corresponding windscreen value.

Allianz Malaysia is offering e-hailing Grab add-on for you. Here in this blog we are detailing all the add-ons that are worth-having to be included to your policy. Options to insure those specific risks available in most policy add-ons.

Protect your vehicle with our Add-On plans. Motor Takaful plan with super value add-ons to protect you and your loved ones. Ad Safe Driver Promo Is Back.

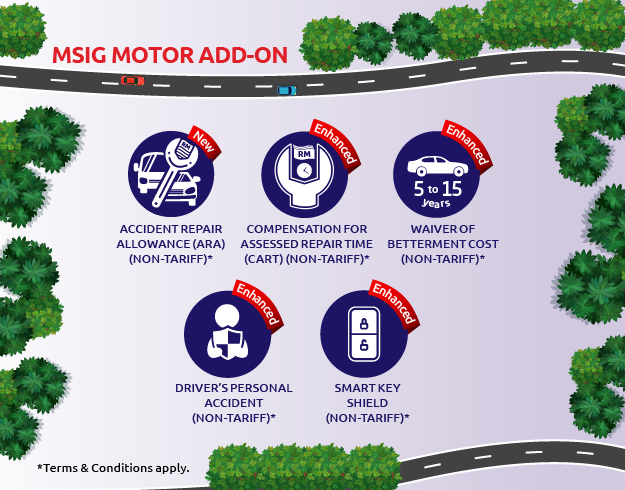

Motor insurance protecting you on the road. Provides an add-on coverage for your Comprehensive Motor Private Car Policy which include a full body spray painting for your entire vehicle. Lets take a closer look at every one of them.

There are three kinds of car insurance policies in Malaysia. Motor Add-On RHB Motor Add-On keeps you safer by giving your car the extra coverage it needs. Get Double Rewards Total Worth RM100 When You Renew Your Car Insurance Online.

Refer to your currentprevious car insurances policy schedule renewal notice. Takaful Malaysia Car Insurance Their company is one of the leading Takaful operators in Malaysia with a reputation for providing customers with financial strength and risk management expertise. This is why we have designed Z-Driver Takaful - a comprehensive motor takaful plan.

Insurance Add Ons Worth Adding. They have grown consistently over time to meet customer needs while also maintaining profitability all at an affordable price. Second party and comprehensive.

How to Renew Road Tax and Insurance Your car insurance and road tax renewal can now be done online or offline. Our goal is to ensure that you understand and are satisfied with the insurance package before purchasing. Get your motor quote in.

201901006370 1315697-H is an approved participant in the Bank Negara Malaysia Financial Technology Regulatory Sandbox. An Insurance plan for E-Hailing Grab Drivers. With MSIG Motor Plus Insurance seven preselected add-on is provided to you for better protection and value.

Under the Act of 1987 on Road Transport all vehicle owners in Malaysia have to be subject on an annual basis to legal car insurance and road tax. Provide an unlimited breakdown towing or an on-site repair to your.

E Hailing Motor Insurance Add On Benefits For E Hailing Drivers

Motor Insurance Tokio Marine Malaysia An Insurance Company

Etiqa S New Usage Based Add On Offers Up To 30 Rebate On Motor Insurance Premium

0 Response to "Malaysia Car Insurance Addon"

Post a Comment